iCar Asia again reports record quarterly cash receipts

January 14th, 2020

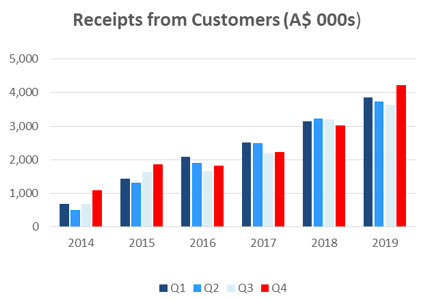

- Record quarterly cash receipts for Q4 2019 of A$4.2million, up 39% year on year

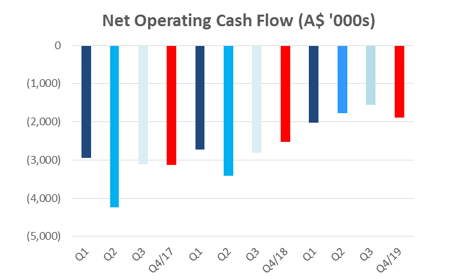

- Net operating cash flow improved by 37% for full year 2019 and by 25% year on year for Q4

- Malaysia and Thailand EBITDA and cashflow positive for the full year of 2019

- Indonesia almost halved its EBITDA loss for the full year of 2019

- Carmudi Indonesia transaction completed

- Group reached EBITDA breakeven in November 2019

- 2020 expected to deliver in excess of 50% growth in revenue

14 January 2020 – iCar Asia Limited (‘iCar Asia’, the ‘Group’ or the ‘Company’), ASEAN's number 1 network of digital automotive marketplaces, has published its Appendix 4C for the fourth quarter of 2019.

Record quarterly cash receipts for Q4 2019 of A$4.2 million

The Company reported record cash receipts for the fourth quarter of A$4.2million, up A$1.2 million or 39% versus Q4 2018. The growth was driven by strong cash collections in all business units including Used Car and New Car (including events in Malaysia) across all 3 countries, as well as the contribution from the one and a half months of Carmudi Indonesia’s operations. Even excluding the impact of the Carmudi acquisition, the Company reached a record quarterly cash receipts result in Q4 2019.

As communicated in previous announcements, the receipts above do not include gross receipts from the auction business, which are separately disclosed as net receipts.

Net operating cash flow improved by 37% for full year

Strong cash receipts growth and lower expenditure led to a significant decrease in Net Operating Cash Flow by 25% over Q4 2018 and 37% on annual basis versus 2018. This is a result of iCar Asia’s operations in Malaysia and Thailand now consistently being positive cash contributors, Indonesia halving its net cash outflow and corporate costs remaining stable versus 2018. This result includes the Carmudi acquisition transactions costs, initial impact of the Carmudi business operations before synergies are fully realized, plus a number of one-off expenditures in Q4 including increased insurance premiums.

As previously communicated, the expected full realisation of revenue and costs synergies in Indonesia off the back of the Carmudi acquisition will require the Group to sustain a short investment period of a few months, reflected in higher expenses for this period. Following this period the Group expects to return to EBITDA breakeven and profitability. Absent of any other changes, the Group is expected to become cash flow positive in the second half of 2020 as per its previous guidance, and be EBITDA positive in aggregate for the entire year.

The Company closed the year with A$6.8 million in cash and cash equivalents after taking into account the payment of purchase consideration of the initial payment in relation to the acquisition of Carmudi Indonesia of U$1.55m (approximately A$2.29m). The Company also has access to additional funds in the form of a A$5 million debt facility. The Company expects to utilize only its existing cash and cash equivalents as it grows the business to cashflow breakeven and is not factoring in drawing down on the loan or accessing any other capital in its current expenditure plans.

Completion of Acquisition of Carmudi Indonesia.

As announced on 19 September 2019, the Company has entered into a binding agreement to acquire Carmudi Indonesia and on 12 November 2019, the Company further announced that this acquisition was completed.

The combined Indonesian business is expected to more than double iCar Asia’s Indonesian revenues, increasing the overall contribution of Indonesia to the Group’s revenues from approximately 12% to 22%. The identified synergies are expected to result in the combined Indonesian businesses breaking even in 2020.

Outlook for 2020

Following the Group reaching EBITDA breakeven in November 2019, the outlook for 2020 remains very positive. iCar Asia is on track to have a strong year with revenue currently expected to grow by 50% or more on a year to year basis. This will be achieved through consistent growth of the Group’s core businesses, as well as the contribution of the Carmudi business for a full year. Based on this current outlook, the Group is expected to become cash flow positive in the second half of 2020 as per its previous guidance, and be EBITDA positive in aggregate for the entire year.

The CEO of iCar Asia Limited, Mr. Hamish Stone commented: “The year of 2019 was a highly successful year for the Group as we achieved run rate EBITDA breakeven for the Group in November 2019, one month ahead of our guidance. With the acquisition of Carmudi Indonesia now completed, we look forward to an even more successful year in 2020 where we will leverage on our leadership positions in all 3 countries to further grow our business portfolio into greater profitability.”

For more information please contact:

About iCar Asia Limited (www.icarasia.com)Listed on the Australia Securities Exchange, iCar Asia (ASX: ICQ) owns and operates ASEAN’s No.1 network of automotive portals. Headquartered in Kuala Lumpur, Malaysia, the company is focused on developing and operating leading automotive portals in Malaysia, Indonesia and Thailand. iCar Asia is continuously working to capitalise on its market-leading positions, with its online properties currently reaching approximately 12million car buyers and sellers in the region every month.iCar Asia Network of websites:

|